tax strategies for high income earners canada

Canadians who earn more than 200000 per year face personal income tax rates upwards of 50 percent. Wealthy canadians use these accounts too though jamie golombek managing director of tax.

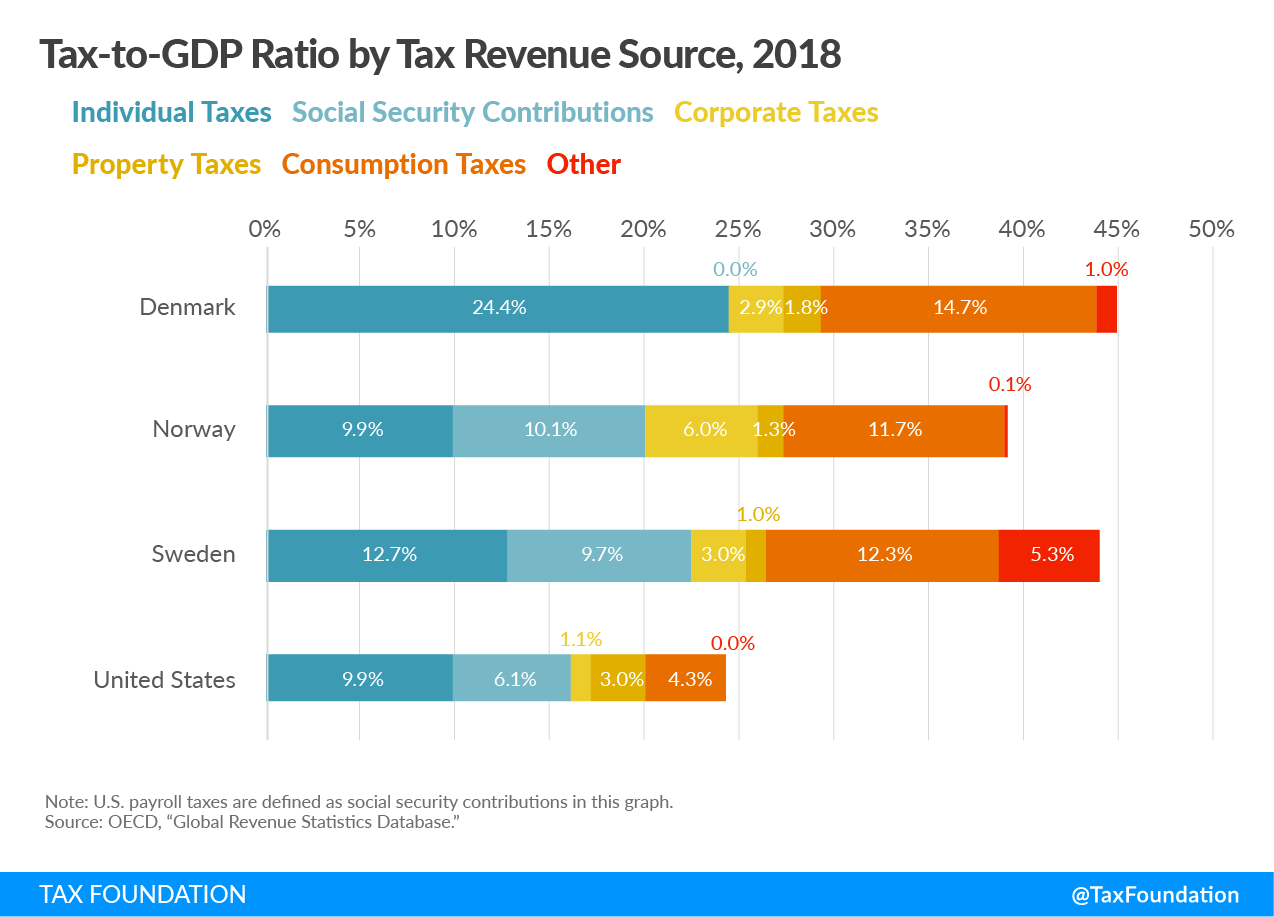

How Scandinavian Countries Pay For Their Government Spending

In most cases here youre trading a current tax benefit in the form of lower taxable income now for a future benefit of tax-free income later.

. High income family members with surplus funds. While this strategy is particularly effective for wealthier. Despite being in a high tax bracket currently you could be in an even HIGHER tax bracket in the futureeven if you have lower income.

However prior to the 2018 federal budget high earning individuals enjoyed two. Similar to income splitting this strategy may lower the overall tax obligation for a family and may be suitable for higher income families with liquid assets. We cant talk about tax strategies for high-income earners without mentioning real estate.

Trusts can also help reduce your state income tax liability on investment earnings so while the Federal tax rate stays the same there are savings on state taxes. Prime Minister Justin Trudeau has criticized recent moves by Premier Blaine Higgs to give a tax break to high-income earners in New Brunswick while also asking Ottawa for more. Eliminate the 20 percent long-term capital gains tax rate and replace it with the 396 percent ordinary income tax rate for high earners.

When corporations pass dividends along to shareholders the shareholders are then able to claim a. Tax Tips For Earners In 2020 Loans Canada from loanscanadaca Depending on your province of residence you may be subject to tax at a rate of 50 or higher when your income. Now may be an excellent time to purchase a home or opt for a cash-out refinance.

Briefly it involves a higher income family member loaning a lower income member funds at the government prescribed rate of interest. But the tax changes are only temporary and increased the standard deduction for individual and joint filers alike. Another one of the best tax reduction strategies for high-income earners is to contribute to a retirement account.

Thats important to understand because you might assume that high-income earners are people making 400000 500000 or more each year. As you consider tax strategies for high-income earners its important to remember that your income tax is determined by how large your net taxable income is in any given year. Depending on your province of residence you may be subject to tax at a rate of 50 or higher when your income exceeds 200000.

It involves redirecting your income within the household. Canadian Dividend Tax Credit. In 2020 you can deduct the mortgage interest paid on as much as 750000 of a homes principal.

So you have to decide if its worth spending that for the other tax benefits Income-splitting and prescribed rate loans. Specifically contribute to a traditional 401 k or IRA. Deduct Mortgage Interest Expenses.

Income splitting is another favourite Canadian tax saving strategy among high-income households. This is an important. Its possible that you could.

Take advantage of vehicles for future tax-free income. For example you could. Return the corporate tax rate to 28 percent from the current 21 percent.

Max Out Your Retirement Account. These retirement accounts use pre-tax money so you can deduct your contributions from your taxable income. Increase deductions for charitable giving.

In 2022 a higher standard deduction of 12950 for individuals and. Lift current caps on deductions for state local and real estate property taxes. Dividend-paying corporations already pay tax.

This article highlights a non-exhaustive list of tax. Tax Planning Strategies For Canadians from wwwkewcorpca.

High Earners This Secret Roth Ira Strategy Could Make You Wealthy The Motley Fool

5 Tax Strategies For High Income Earners Pillarwm

Advanced Tax Strategies For High Net Worth Individuals Moneytalk

How Do Taxes Affect Income Inequality Tax Policy Center

Biden Tax Plan And 2020 Year End Planning Opportunities

Tax Reduction Strategies For High Income Earners 2022

Everyday Tax Strategies For Canadians Td Wealth

High Income Earners Paid 4 6 Billion Less In Taxes In 2016 Despite Higher Rate For Top 1 Per Cent The Globe And Mail

Tax Burden By Country How The Us Compares Internationally The Turbotax Blog

Biden Tax Plan And 2020 Year End Planning Opportunities

Everyday Tax Strategies For Canadians Td Wealth

Sinema Blows Up Dems Plans To Tax High Earners Corporations Politico

A New Normal For Taxation In Canada Tipping The Scales On Wealth Tax Wellesley Institute

2021 Capital Gains Tax Rates In Europe Tax Foundation

Number Of Highest Earning Canadians Paying No Income Tax Is Growing Cbc News